A special guest post from our friend Benjamin Feldman at Unison!

“The client was thrilled to get the home he wanted without having to liquidate investments and take the tax hit.”

Looking for a Home in Santa Margarita

Andy’s client was looking for a home in Rancho Santa Margarita, a beautiful area with many nice residential neighborhoods and modern homes. He wanted to find somewhere he would be comfortable and not too far away from work and other amenities.

When evaluating his client’s financing options, Andy realized that the buyer would need to put down 20% to get approved for the mortgage. The buyer had enough assets for the 20% down payment. The client didn’t want to put all the money into his new home and he didn’t want to liquidate his various investments.

Partnering with Unison

Andy introduced the client to the Unison HomeBuyer program. With a home ownership investment from Unison, the buyer could put down only 10% and Unison would match his funds, bringing his total down payment cash to 20%.

With half of the down payment funds coming from Unison, the buyer would not have to take money from his other investments for the down payment. At first, the client had some questions about how the program worked. But once he understood that Unison would invest alongside him in the home and share in the future change in the home’s price — up or down — he was enthusiastic to use the program.

Getting the Home with Flexible Financing

The client partnered with Unison on the down payment and bought the home he wanted. Glad to keep his existing investments, the buyer could avoid paying extra taxes he would have incurred by liquidating them.

Now he doesn’t have all of his money tied up in the home, and he will have more flexibility with his finances in the future. The Unison HomeBuyer program allowed him to get the home he wanted without taking on more debt or using all his money for the down payment.

A Powerful Tool for Loan Officers

Andy appreciates the Unison HomeBuyer program because of the additional options it gives his clients. It also helps him make connections with real estate agents who are looking for solutions for their own clients. Taking advantage of Guild Mortgage’s access of Unison HomeBuyer, Andy differentiates his business and offerings by bringing this program to the table as an option.

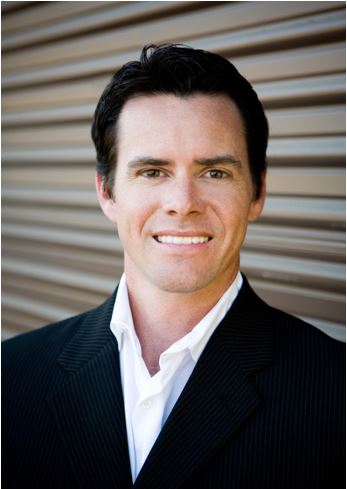

About Andy

Andy Brown is a husband, father, and cycling enthusiast who lives in Carlsbad, California, near San Diego. He is also a Branch Manager and Loan Officer for Guild Mortgage, one of the top mortgage companies in the region. He has been a loan officer since 1997 and brings a wealth of experience to his interactions with clients.